Air Transport Production Increases Could Slow

Source: Aviation Week & Space Technology

Analysts say that commercial aerospace continues to position for expected production rate ramp-ups of large commercial aircraft in 2019.

That further increases for next period could be more gradual than in recent years, in part due to issues remaining from 2018. If so, the development might be welcomed by a skeptical supply chain, as providers and their investors eye how much to pony up for additional growth.

In several forecasts released in late December and early January, analysts predicted the two leading large commercial aircraft (LCA) OEMs, Airbus and Boeing, will reach their expected rate increases already announced for 2019. What’s more, they may increasingly discuss additional acceleration more openly, as both OEMs are pressured to monetize their record backlogs of orders.

Narrowbody production problems are continuing this year, meaning further ramp-ups could take longer than usual to work through the supply chain and production system, and slower-than-market consensus has modeled to date.

Some of that hesitation might have to do with how scarring 2018 turned out. The primary story for the aerospace industry in 2018 was the supply chain disruptions, castings and forgings suppliers seemed to be the most often cited source of the delays. Airbus also faced significant delays with its A320neo due to engine delays. Issues with interiors were also a factor on some widebody aircraft, and even Rolls-Royce had issues that led to both delays in some 787 deliveries, as well as several disruptions of in-service aircraft.

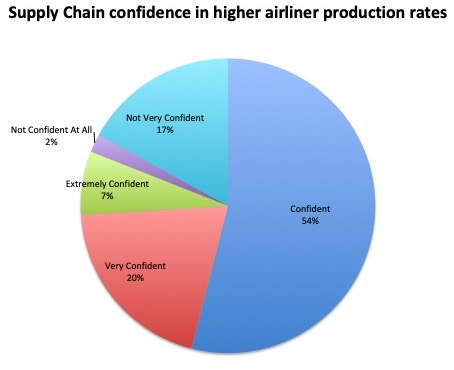

A December survey of the global aerospace and defense supply chain by Verify, a major A&D supplier performance management company, indicated almost 20% of the supply chain has little or no confidence in supporting narrowbody increases above those planned in 2019, while just under 30% are very confident. Only 17% in the Verify survey said the issue was supplier capacity, while 42% cited requirement flow down, and 24% cited schedule volatility.

However, considering the issues in 2018, analysts believe the leading OEMs and their Tier 1 suppliers are spending more time and capital to do all possible to minimize this risk across the industry.